Does Homeowner’s Insurance Cover Mold Damage?

Many homeowners in Morris County assume that if they ever face a mold problem, their insurance company will automatically cover the cleanup costs. Most standard homeowners' insurance policies exclude mold damage unless it results from a sudden, covered peril such as a burst pipe or an accidental overflow. The National Association of Insurance Commissioners (NAIC) says that many policies include limited or no mold coverage unless endorsements or add-ons are purchased.

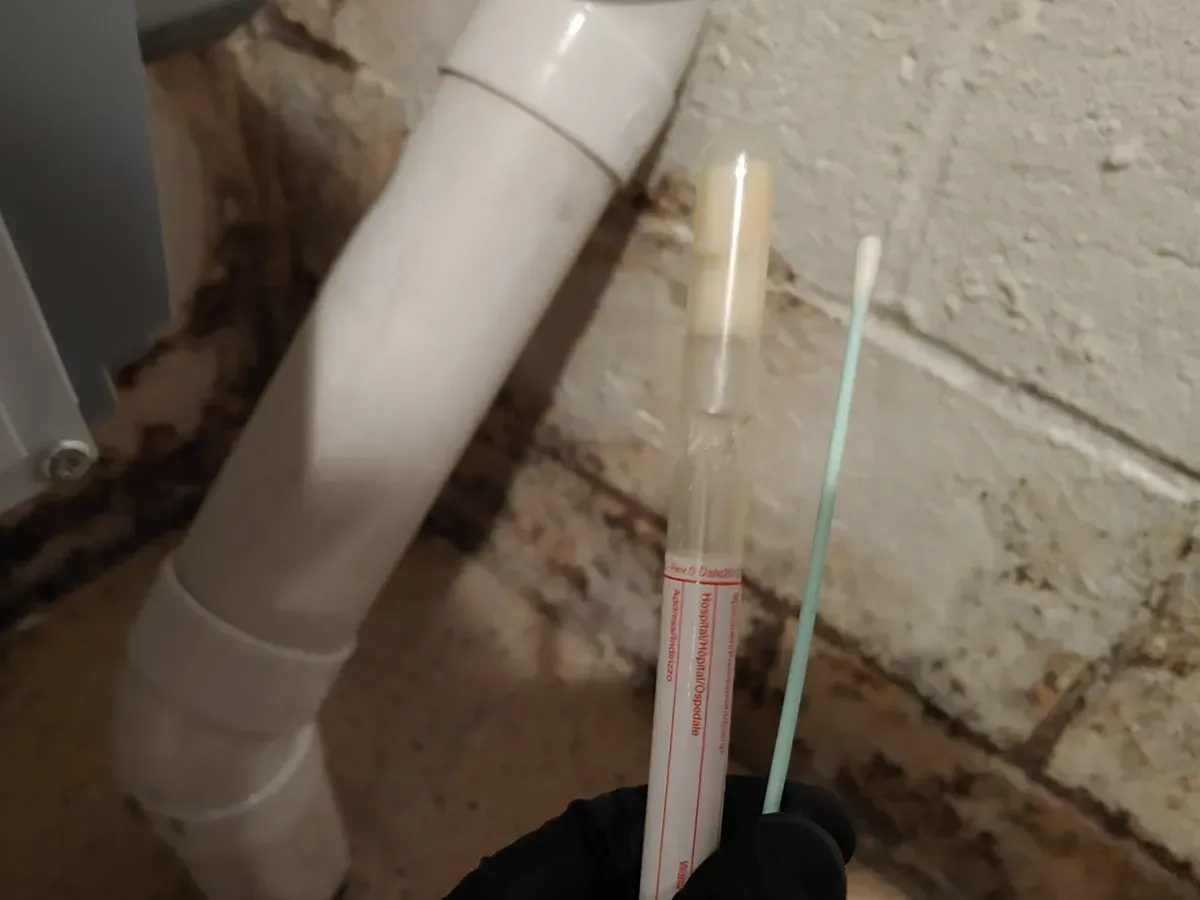

For homeowners considering mold remediation Bridgewater NJ, understanding how insurers define “covered” versus “maintenance-related” damage is essential. Mold linked to gradual leaks, humidity, or poor maintenance is typically not covered under a policy. Knowing these distinctions helps homeowners make informed choices about maintenance, documentation, and optional coverage before a claim becomes necessary.

Why Mold Is Usually Excluded

Insurance companies generally classify mold as a preventable maintenance issue, not an “accidental” loss. The Insurance Information Institute notes that homeowners' insurance is designed for “sudden and accidental” events, not ongoing conditions caused by neglect. For example, a small leak that has gone unrepaired for months, leading to mold, is viewed as owner negligence, not a claimable disaster.

Likewise, the NAIC’s consumer guide explains that mold is often excluded from coverage unless a homeowner has purchased a specific mold endorsement. Mold damage from humidity, condensation, or long-term dampness is therefore excluded in the same way policies exclude rot, pest infestations, or deterioration.

In short, insurers consider mold prevention part of routine home maintenance, like keeping gutters clear or sealing foundation cracks, rather than an insurable event. Homeowners in Somerset and Morris Counties who later need mold remediation in Bridgewater, NJ, often discover these limits too late, after coverage has already been denied.

The “Covered Peril” Pathway and New Jersey-Specific Rules

Mold may be covered when it’s a direct result of a covered peril. As the III clarifies, mold remediation is sometimes paid “only to the extent necessary to repair damage from a covered peril.” For example, if a pipe bursts suddenly and the resulting water leads to mold, your insurer may cover the cost of drying and cleanup. However, even in those cases, most policies impose caps or sub-limits, often between $1,000 and $10,000.

New Jersey’s Department of Banking & Insurance (NJDOBI), through Bulletin 02-14, specifies that all insurers must offer at least $10,000 in annual aggregate coverage for mold damage that results from a covered peril. Homeowners can choose to purchase higher limits, usually up to $25,000 or $50,000, for an additional premium. The bulletin details that covered items may include property damage, necessary tear-out, and testing. However, it does not cover mold caused by maintenance failures, long-term leaks, or general dampness.

In practice, even if your insurer pays a claim, they’ll typically cap the payout and expect thorough documentation that proves the cause was sudden and accidental.

Flood Coverage and the NFIP Mold Exception

A crucial distinction: standard homeowners’ insurance never covers flood damage. Flood-related mold is handled under National Flood Insurance Program (NFIP) policies, and even there, coverage is narrow. According to FloodSmart.gov, the official NFIP portal, damage from mold, mildew, or moisture that could have been avoided or that wasn’t caused by flooding is excluded. Adjusters frequently deny mold claims if they determine homeowners delayed mitigation or failed to ventilate.

At the same time, FloodSmart warns that “mold can begin within 24–48 hours” after flooding and urges homeowners to clean and dry immediately. The takeaway is clear: flood insurance helps only when you act fast. Mold that develops later, even after a covered flood, may still be deemed avoidable and denied.

Protect Your Home Before the Damage Starts

Standard homeowners’ insurance doesn’t cover most mold damage, and even when it does, payouts are limited. Don’t wait for a claim to teach you the limits of your coverage. Review your policy, ask your agent about mold endorsements, and take steps today to prevent moisture buildup in your home.

If you’re already dealing with mold or moisture problems, contact a trusted professional for mold remediation Bridgewater NJ to restore your property safely and prevent recurring damage. In Morris County’s damp climate, prevention isn’t just smart; it’s the only sure protection against costly, uncovered mold damage.